When someone suffers a catastrophic injury, the initial impact is only part of the story. The cost of care after injury stretches far beyond hospital stays and emergency surgeries. It’s what comes next. Years of therapy, equipment, home modifications, and caregiver support define the true financial burden.

For attorneys and legal teams, these long-term costs are not optional add-ons, they’re essential to proving damages. Without a clear, defensible life care plan, it’s easy to underestimate the economic impact and miss critical support your client will need for decades.

What Is a Life Care Plan?

A Life Care Plan is a comprehensive roadmap that outlines a person’s medical, functional, and supportive care needs following a catastrophic injury or illness. It provides:

- – Detailed projections of all future medical and non-medical needs

- – Current, regionally appropriate costs of services and equipment

- – A defensible foundation for claim valuation or settlement

But this isn’t just a document. It’s a critical piece of litigation strategy anchored in medical evidence and built to withstand scrutiny.

Why Costs Are So Often Underestimated

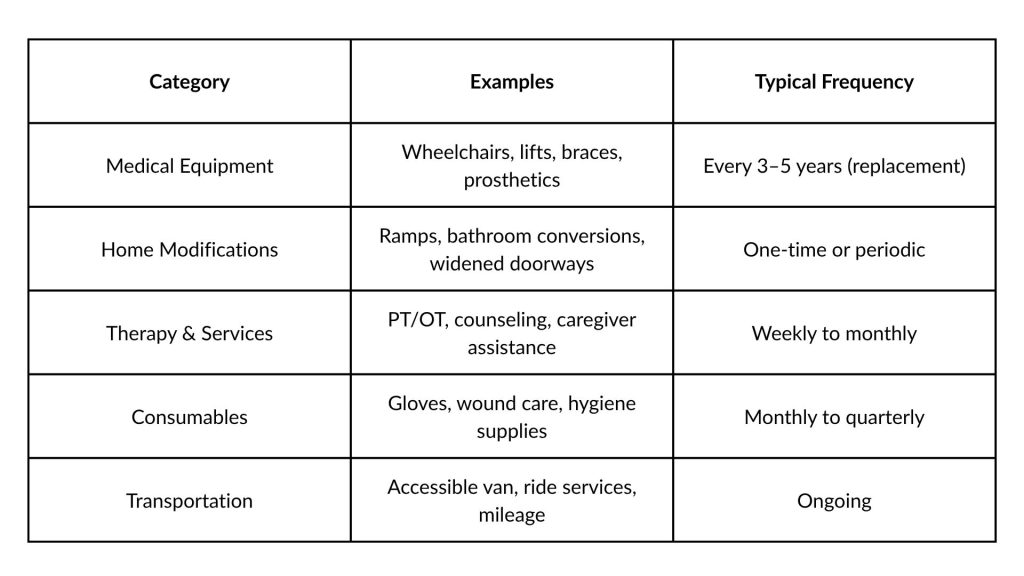

The hidden danger in many personal injury cases is under-projection. Even experienced litigators may overlook long-term expenses, especially those that seem small or routine. This is where clear medical cost projections make a measurable difference.

These costs don’t just add up, they compound. A missed $400 monthly expense becomes a $96,000 error over 20 years. And that’s just one category.

The High Cost of Ambiguity

In litigation, clarity is leverage. Vague projections open the door for opposing experts to challenge validity or downplay the injured party’s needs. A detailed Life Care Plan neutralizes this by:

- – Establishing objective evidence: All recommendations are tied to medical records, clinical guidelines, and accepted standards of practice.

- – Anticipating defense arguments: Certified planners consider long-term injury trajectories and potential complications.

- – Quantifying subjective losses: Quality-of-life impacts, like mental health care or caregiver support, are translated into economic terms.

A well-prepared Life Care Plan doesn’t just respond to scrutiny—it prevents it from gaining traction.

Real-World Examples: Why Life Care Plans Matter

Understanding the full scope of an injury is more than clinical, it’s personal. The following real-life scenarios show how Life Care Plans translate complex health issues into clear, documented needs that strengthen legal claims.

Example 1: Pre-Existing Condition Complicated by Accident

A 45-year-old man had mild neck degeneration and resolved symptoms after physical therapy. Following a car accident, he experienced constant neck pain, arm tingling, and functional impairment. An MRI revealed a new disc herniation. A Life Care Plan distinguishes between prior resolved conditions and new trauma, providing evidence for ongoing care and damages.

Example 2: Denied Claim Despite Medical Proof

A 30-year-old woman with a family history of diabetes fell at work and developed left leg numbness. Despite EMG-confirmed L5 nerve root impingement, her claim was denied due to a pre-diabetic label. A Life Care Plan can clarify causation, connect clinical findings to the workplace injury, and challenge unjust denials.

Example 3: Unexpected Complications After Routine Procedure

A 49-year-old man underwent a colonoscopy where a polyp removal led to bowel perforation and surgical repair. While recovering, he developed vision issues and assumed they were connected. A Life Care Plan clarifies unrelated symptoms and outlines the actual impact of the procedure complication, avoiding confusion in case valuation.

Example 4: Chronic Neurological Impact from TBI

A 28-year-old woman with occasional migraines sustained a traumatic brain injury in a car crash. Post-injury, her symptoms worsened. With daily flares, dizziness, and memory issues, she can no longer work and current medications are ineffective. A Life Care Plan documents her long-term neurological care needs, supports Botox treatment recommendations, and justifies loss-of-work compensation.

It’s More Than a Number—It’s a Life Story

It’s not just about estimating expenses. A Life Care Plan tells the story of life after a catastrophic injury. The physical, emotional, and logistical challenges your client faces. It helps the court see not only what was lost, but what it will take to rebuild. It documents:

- – Daily living challenges: Bathing, dressing, meal prep, mobility

- – Access and inclusion: Can the person enter their home or navigate public spaces?

- – Ongoing care needs: Nighttime assistance, mental health services, caregiver rotation

These aren’t just line items, they are the infrastructure of recovery. Without documentation, they’re easily overlooked or dismissed.

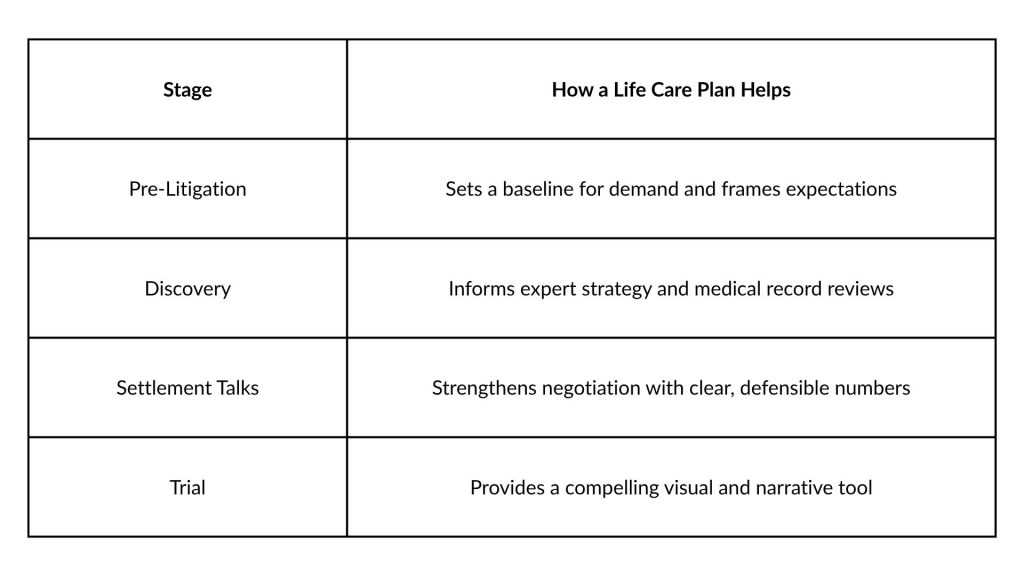

The Legal Advantage of Early Planning

Too often, attorneys wait until mediation or trial to commission a Life Care Plan. But the earlier it’s done, the more strategic value it adds:

The right plan isn’t just admissible, it’s persuasive. Judges, juries, and mediators can see, in concrete terms, what the injured person needs and why.

A Note on Credibility: Who Builds the Plan Matters

Not all Life Care Plans are created equal. Who builds the plan matters. A qualified nurse life care planner brings both clinical expertise and litigation credibility. A credible plan must be:

- – Developed by a certified life care planner (CLCP or CNLCP®)

- – Based on current, objective data (e.g., Medicare schedules, regional rates)

- – Reviewed against modern treatment trends and medical standards

The best planners don’t just list services. They anticipate complications, document long-term support needs, and tailor each plan to withstand cross-examination.

Final Word: It’s Not Just Documentation, It’s Dignity

At the heart of every Life Care Plan is a human being. Someone whose life changed dramatically. Someone whose future needs clarity, compassion, and support.

By investing in a plan that is thorough, medically sound, and legally defensible, you’re not just building a case. You’re securing care, protecting dignity, and giving your client a documented path forward.

And that’s worth every dollar.