For attorneys and insurance professionals, understanding Medicare Set-Aside (MSA) allocations is not just beneficial but essential in navigating the complexities of settlements involving Medicare beneficiaries. MSAs play a critical role in protecting both clients and the integrity of the Medicare program by ensuring that funds are appropriately designated for future medical expenses related to injury claims.

In this article, we aim to provide a comprehensive overview of what Medicare Set-Aside allocations entail, how they are utilized within the framework of settlements, and the potentially severe consequences of failing to comply with regulatory requirements. A thorough understanding of this topic is indispensable for professionals seeking to safeguard their clients’ interests while adhering to the legal and ethical obligations tied to Medicare compliance.

What is the Medicare Set-Aside Allocation?

The Medicare Set-Aside allocation is a document that outlines future injury-related medical needs and associated costs. This document only includes Medicare-covered expenses, such as doctor visits, physical therapy, equipment, and medications. The set-aside must be carved out from the rest of the settlement and used specifically for those medical expenses.

In 2006, Centers for Medicare & Medicaid Services (CMS) began auditing workers compensation and liability settlements to ensure that the Medicare Set-Aside was addressed in the settlement paperwork. While submission of the MSA is not mandatory, CMS may deny the claimant future medical care or even designate their own allocations if it’s not submitted.

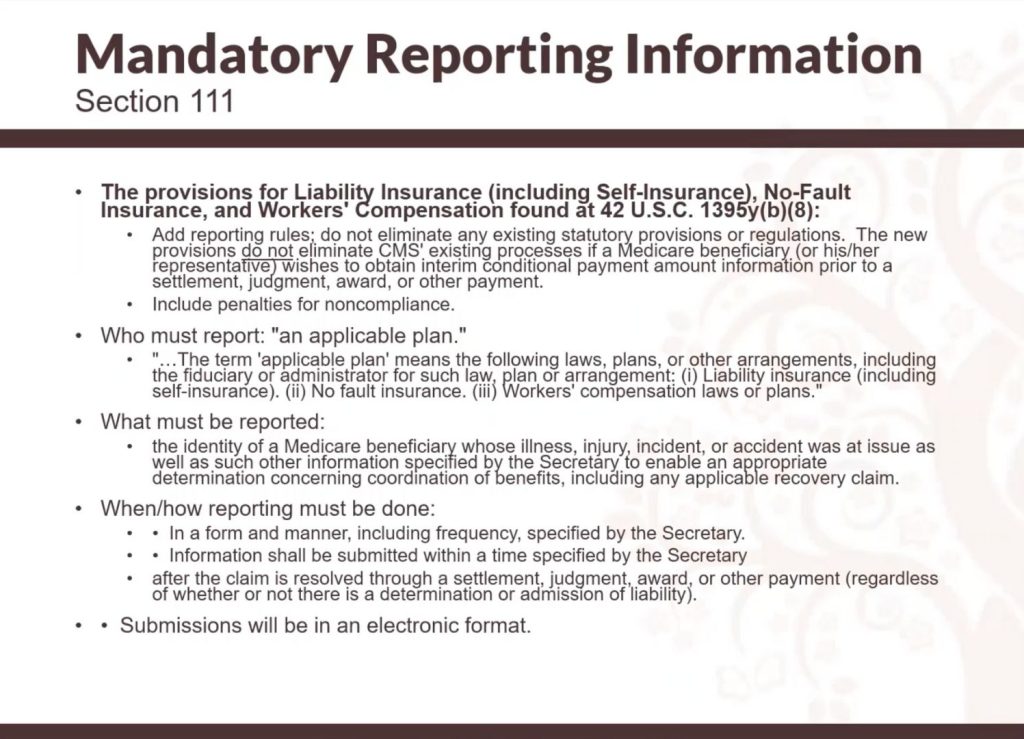

In 2003, the MSA was required in subrogation cases and if liability relieves workers compensation. In 2009, mandatory reporting or section 111 reporting became effective. This means that the applicable plan (person responsible for the law, plan, or arrangement of the plan in liability insurance, health insurance, no-fault insurance, or workers compensation) must report information to CMS when there’s a beneficiary involved in a suit.

What Must be Reported?

The applicable plan must report specific information to CMS, including the beneficiary’s demographics, primary plan type, and ICD-10 codes for the body parts. The settlement date, amount, and how the claim was resolved must also be reported. All submissions must be done in an electronic format through a CMS portal.

Consequences of Non-Compliance

CMS may deny the claimant future medical care, designate their own allocations, or even sue the claimant or their attorney for double damages in liability cases. The federal government found more than $40 billion in legitimate and enforceable liens against claim settlements that did not contain approved allocations or did not take into consideration Medicare’s interests.

The Medicare Set-Aside allocation is an important document that must be considered when settling workers compensation or liability cases. To avoid the consequences of non-compliance, it’s important to start thinking about Medicare in your current settlements and how you’re going to deal with it.

The Smart Act of 2013, also known as the Strengthening Medicare and Repaying the Taxpayers Act, was a piece of legislation that was introduced in 2011 and signed into law in January of 2013. This act made important changes to the civil penalties for non-reporting under Section 111 of the Medicare program. Prior to this act, there was a $1,000 per day penalty for non-compliance, but the Smart Act made this penalty discretionary.

The Smart Act also streamlined the process for obtaining conditional payments from Medicare. Prior to the act, the process was often slow and bureaucratic, with long waiting times and the possibility of lost requests. Now, there are specific timelines for the issuance of conditional payment information, and the information can be accessed through a portal on the same day.

The act also introduced an appeal process for Medicare Set-Aside allocations (MSAs), also known as re-review. However, not all MSAs are eligible for re-review, and specific criteria must be met. The act also limited the time frame for claims against plans and beneficiaries and required the discontinuation of the use of Social Security numbers or health insurance claim numbers as identifiers.

To develop an MSA, it is important to submit a report to the Centers for Medicare & Medicaid Services (CMS) that summarizes the injury, previous care, medication, and future costs. The submitter letter must include demographics, ICD-10 codes, and a consent form with signatures from all parties who will receive a copy of the CMS response. Other important documents to include are a life care plan if one exists, a settlement agreement or court order, and medical records, payment histories, and any additional information that may be relevant.

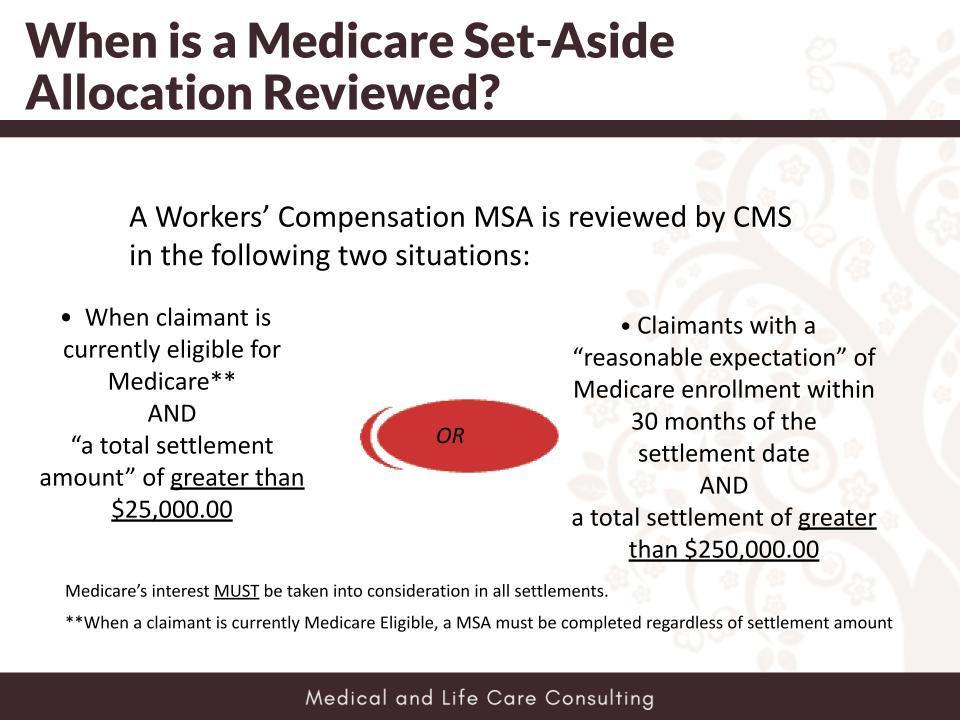

Medicare Set-Aside Allocations Review

Medicare Set-Aside allocations are reviewed by the Centers for Medicare and Medicaid Services (CMS) in two specific situations. The first scenario is when a claimant is currently eligible for Medicare and has a total settlement amount of over $25,000. The second scenario is when the claimant has a reasonable expectation of Medicare enrollment within 30 months of the settlement and has a total settlement amount of over $250,000. The total settlement amount includes all future medical expenses, attorney fees, wages, and any repayments of Medicare conditional payments. No safe harbor exists, and Medicare’s interest must be considered for every beneficiary.

MSA Development

The MSA is developed by providing specific information to a company who will be submitting it to CMS. The medical records for the past two years of treatment are reviewed, and future medical care is determined based on CMS guides and coverages. A WCMSA reference guide is available online to guide the entire process and its requirements. Once all parties agree on the submitted MSA, it is sent to the contractor for review.

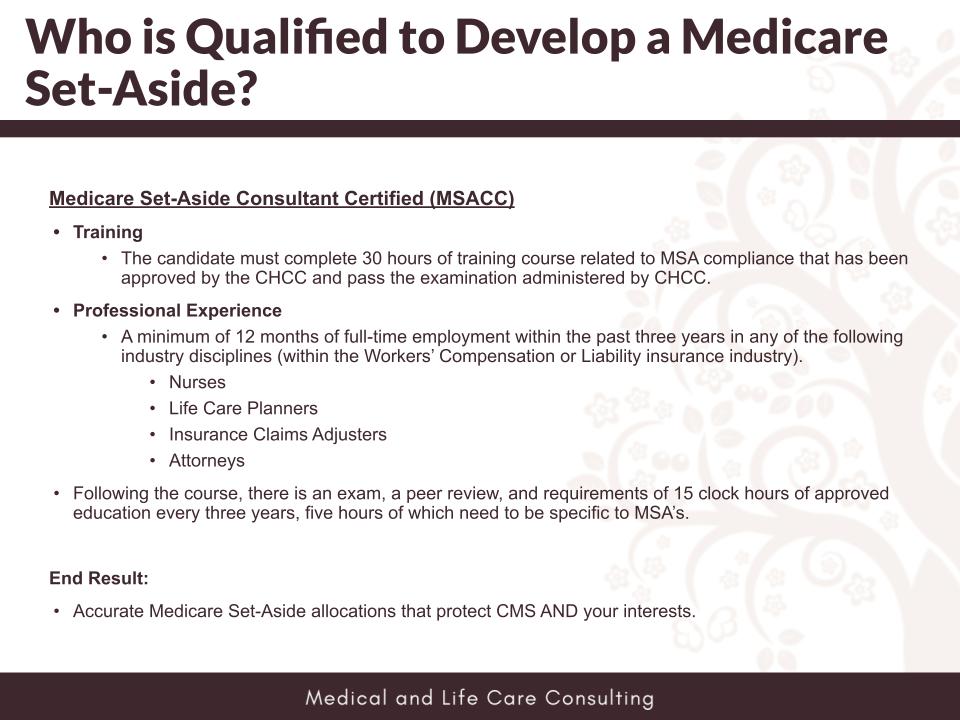

Who Can Develop a MSA?

Anyone can develop a MSA, but a Medicare Set-Aside Consultant Certified (MSACC) designation is available for those who have undergone training and passed a national examination. To be eligible for the MSACC, a person must have at least 12 months of professional experience in the workers comp or liability insurance industry and must maintain their certification with 15 hours of continuing education every three years. MSACCs are qualified professionals who understand Medicare’s regulations and coverage issues.

MSA Administration

The MSA administration can be done in several ways, including self-administration, full custodial administration, self-administration support, and a Medicare secondary payer charitable foundation. Another option is to paper file with a non-expert opinion or to include the MSA information in the settlement documents without submitting it to CMS. It is important to note that MSA submission to CMS is not mandatory.

A zero MSA allocates no funds for future medical expenses. Approval by CMS is rare and usually requires proof that no Medicare-covered treatments will be needed. If the claimant has prior medical payments, a zero MSA is unlikely to be approved.

Life care plans provide a comprehensive picture of future medical and non-medical expenses, unlike medical cost projections, which are often insufficient for trials. A full life care plan reduces additional work and ensures thorough preparation for personal injury cases.

If a surgery was recommended but not pursued, its inclusion in an MSA depends on the recommendation’s timing and frequency. A clear narrative or statement from the patient or provider can justify exclusion.

No, life care plan projections generally don't meet court standards. To ensure admissibility, proper methodologies must be followed. This ensures the plan is a valuable tool in personal injury cases.

Attorneys can request a review of medical records and life care plans. The process includes analyzing records and discussing findings over a call, with a quick turnaround. Additional services may be identified during the discussion.

Peer reviews ensure adherence to care standards and provide a secondary evaluation, improving accuracy and comprehensiveness for the claimant or patient.

Life care planners need medical records from the last two treatment years, even if they were several years ago. These records provide critical insights into medical history and long-term care needs.